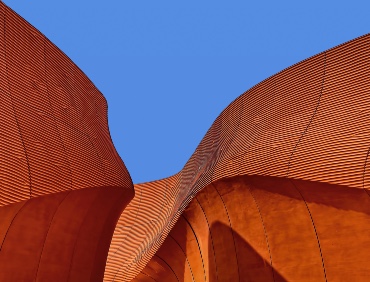

WHEREVER THERE IS DEMAND,

WE SEIZE OPPORTUNITIES

WE BELIEVE IN RESIDENTIAL PROPERTY INVESTMENT

PROPERTY INVESTMENT IN DETAIL

PROPERTY INVESTMENT IN DETAIL

A residential property investment strategy can bring stable, regular profits for investors

RENTS ARE PAID

Tenants pay a monthly rent to the property manager, who then passes it on to Béton Capital.

EXPENSES ARE COVERED

We pay the costs associated with the operation of the property and the day-to-day management of Béton Capital.

PROFITS ARE DISTRIBUTED

We credit the interest to our investors and reinvest the profits in new acquisitions.

OPPORTUNITIES IN RESIDENTIAL PROPERTY

Driven by steady demand, the European residential market grew by 5.4% in 2020 and by 20% on average over the last 10 years.

With prices rising faster than purchasing power, there is a growing demand for rental accommodation, which means that rental vacancy rates are relatively low. We believe in the opportunities offered by the residential rental market, both short- and long-term.

RENTAL INVESTMENT

Our liquidity allows us to seize yield opportunities that enable us to cover the interest paid to our investors to a very large extent.

BUY-IN

In some cases, we resell the properties we acquire directly after renovation in order to realise immediate added value and optimise our results.

INVESTMENT OPPORTUNITIES CURRENTLY AVAILABLE

BC CROISSANCE

CHF 5,000

Minimum

Capitalisation

interest

6% / year

of interest

CHF 5,000 minimum

Capitalisation interest

6% / year of interest

BC Croissance is a fixed-interest bond invested in Béton Capital's rental property portfolio. It allows capitalisation and appreciation of the investment over the long term.

BC REVENU

CHF 5,000

Minimum

Distribution

interest

6% / year

of interest

CHF 5,000 minimum

Distribution interest

6% / year of interest

BC Revenu is a fixed-interest, fixed-capital bond investment in Béton Capital's rental property portfolio. With monthly interest payments from the first month, it generates stable passive income without loss of capital.

BC PARTNERSHIP

CHF 500,000

Minimum

Conditions

Made to measure

Performance

Made to measure

CHF 500,000 minimum

Conditions made to measure

Performance made to measure

BC PARTENARIAT is a made-to-measure bond contract available from CHF 500,000, with features tailored in every respect to the requirements of each investor.

WHY INVEST IN RESIDENTIAL PROPERTY

Over the last 20 years, since 2000, residential property has outperformed all other asset classes, and has had the best return on equity ratio. It also has one of the lowest volatility rates.

Very attractive risk/return ratio with low volatility

Steady demand and favourable demographics

Changes in tenants allow rents and diversification to be revalued

OUR STRATEGY IS ADDED VALUE

At béton Capital we have acquired a large number of properties, and we pride ourselves on adding value to our homes and only letting quality properties.

We focus on added value as an investment strategy with the aim of maximising the value of our assets and income. We also believe in reducing vacancies and tenant turnover by improving tenant wellbeing.

RENOVATIONS AND IMPROVEMENTS.

The value-added strategy involves acquiring properties that need work and offer good potential for optimisation. Generally speaking, the work carried out increases rents and resale value, and reduces costs.

RENTAL INCOME AND APPRECIATION.

During the time our properties are held, the rents received generate income, and therefore a return. We also potentially realise a capital gain on resale.