BC CROISSANCE

A bond investment product offering a fixed annual interest rate of 6%. Income is reinvested each year, allowing interest to be capitalised. The initial capital is fixed for the term of the contract and does not vary. This product is ideal for creating wealth through the appreciation of your investment.

OVERVIEW

A bond investment product offering a fixed annual interest rate of 6%.

Income is reinvested each year, allowing interest to be capitalised. The initial capital is fixed for the term of the contract and does not vary. This product is ideal for creating wealth through the appreciation of your investment.

PROTECTED CAPITAL

There are no fees and no volatility, so your capital is fully protected.

DIVERSIFICATION

Each investment is spread over Béton Capital's entire property portfolio in order to reduce risk.

CAPITALISATION

The interest is reinvested annually with your capital and generates compound interest.

STRATEGY

Béton Capital's diversified investment strategy, financed by bond investments, makes it possible to acquire properties with favourable risk and income structures. All the properties held directly cover each investment by their value, the income generated and the potential increase in value over time.

ADVANTAGE

By diversifying its property acquisitions across different types of assets and geographical areas, Béton Capital is building a portfolio of assets that generate varied and regular income streams.

PROCESS

Béton Capital uses strict procedures to evaluate an investment and assess whether the risk-reward ratio is favourable according to our specifications. We look for strong fundamentals in each acquisition and diversification of property type and location.

Once we have shortlisted a potential acquisition, we assess its suitability from a number of angles: buy-to-let, traditional rental investment, and short-term operation. We analyse the market and the environment to ensure that the investment remains relevant even in an adverse scenario. Once the purchase has been made, our team manages the necessary works, the operation of the property and its marketing, in line with the agreed specifications, in order to maximise its value and realise the expected profits.

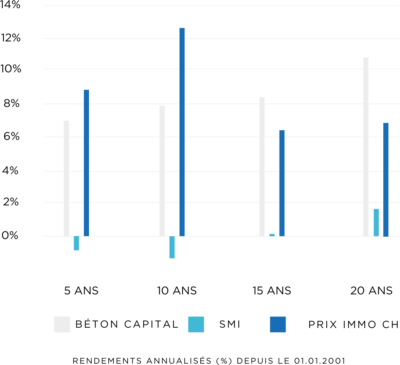

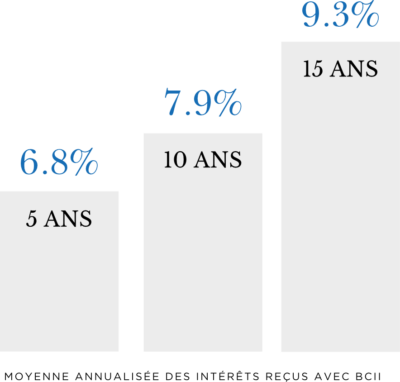

PERFORMANCE OVER TIME

A GUARANTEED FIXED ANNUAL RETURN OF 6.0%