ACCESS THE FULL POTENTIAL OF COMMERCIAL PROPERTY

INVESTING IN PROPERTY

Bonds enable us to guarantee an interest rate that is fixed over time and independent of the results of our activities.

Bonds give the same security to each investor, whose investment is guaranteed by all the properties owned by Béton Capital.

Loan bonds allow you to contractually commit to every detail and condition of your investment.

INVESTMENT OBJECTIVES

Bonds are known for their fixed and variable interest rates.

their medium-term duration, but they offer many more potential benefits.

✓ Income

✓ Portfolio diversification

✓ Capital preservation

✓ Free duration

✓ Liquidity

✓ No charge

COMPARISON OF AVAILABLE BONDS

On the market, investors have access to 3 types of bond.

- Government bonds

- Quoted corporate bonds

- Unlisted corporate bonds

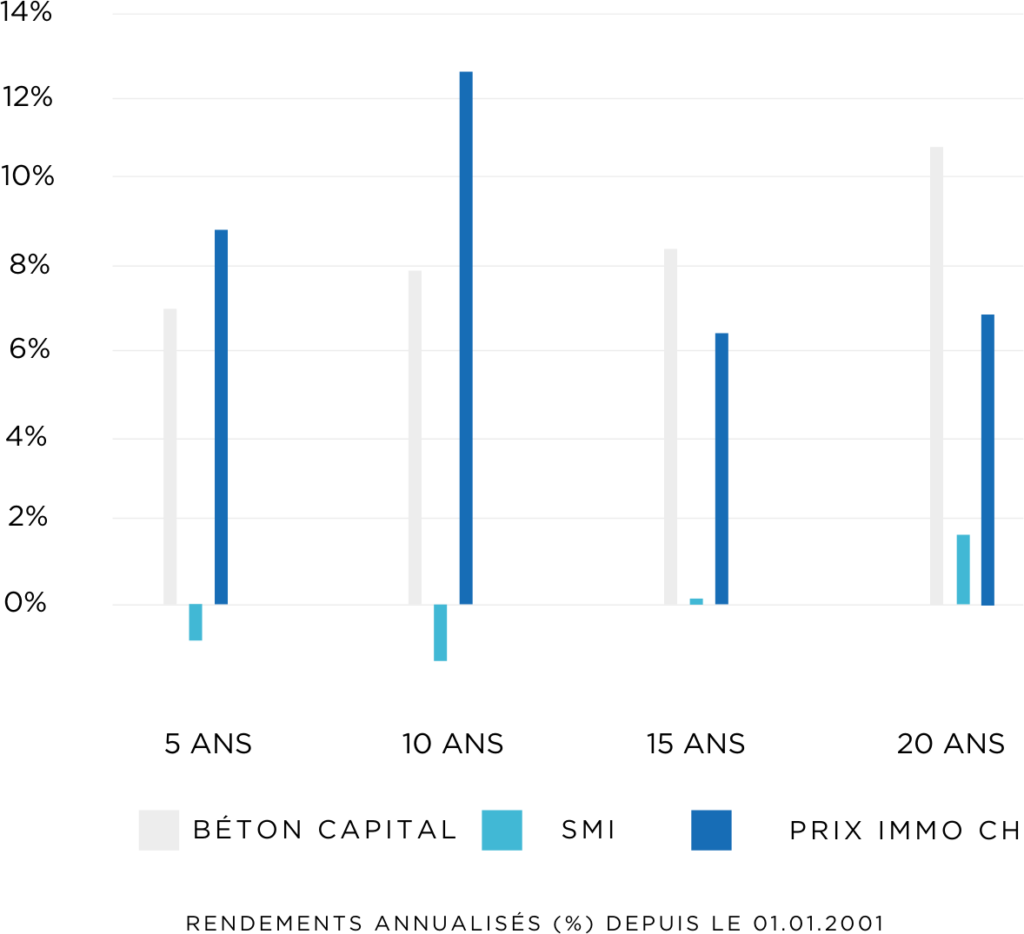

FIND OUT HOW REAL ESTATE CAN HELP YOU ACHIEVE YOUR RETURN OBJECTIVES

With lower volatility than the stock market and historically higher long-term gains, property investment is attractive to capital appreciation investors. The bonds offered by Béton Capital allow interest to be reinvested to take advantage of the potential of compound interest.

FIND OUT ABOUT OUR OBLIGATIONS

FIND OUT ABOUT OUR OBLIGATIONS

BC CROISSANCE

CHF 5,000

Minimum

Capitalisation

interest

6% / year

of interest

CHF 5,000 minimum

Capitalisation interest

6% / year of interest

BC Croissance is a fixed-interest bond invested in Béton Capital's rental property portfolio. It allows capitalisation and appreciation of the investment over the long term.

BC REVENU

CHF 5,000

Minimum

Distribution

interest

6% / year

of interest

CHF 5,000 minimum

Distribution interest

6% / year of interest

BC Revenu is a fixed-interest, fixed-capital bond investment in Béton Capital's rental property portfolio. With monthly interest payments from the first month, it generates stable passive income without loss of capital.

BC PARTNERSHIP

CHF 500,000

Minimum

Conditions

Made to measure

Performance

Made to measure

CHF 500,000 minimum

Conditions made to measure

Performance made to measure

BC PARTENARIAT is a made-to-measure bond contract available from CHF 500,000, with features tailored in every respect to the requirements of each investor.

INVESTING IN BONDS FOR RETIREMENT

Investing in property can be a good way of diversifying your retirement assets, building them up and generating income over the long term.

INVESTING IN THE SECOND PILLAR

The average conversion rate for the second pillar is currently 5.2% and may be even lower for the mandatory portion.

You have the option of withdrawing part of your second pillar and investing it in one of our loan bonds to obtain a better pension while keeping the capital available.

LONG-TERM STRATEGY

If you are looking to increase the value of your retirement capital with a long-term strategy, our loan bonds with BC Croissance offer you the opportunity to benefit from added value while reducing your risk by diversifying your investment across all our properties.